ANI (Agencia Nacional de Infraestructura de Colombia) is currently structuring five investment projects that entail new concessions for seven airports, the expansion of nine existing terminals and building nine new ones, for a total investment of 6.8tn pesos (US$2.4bn).

ANI (Agencia Nacional de Infraestructura de Colombia) is currently structuring five investment projects that entail new concessions for seven airports, the expansion of nine existing terminals and building nine new ones, for a total investment of 6.8tn pesos (US$2.4bn).

The projects are:

San Andrés and Providencia airport (227bn pesos)

A concession for the airports of San Andrés and Providencia was awarded to consortium CASYP in 2007, but was terminated in 2014, because, as ANI argued, the operator incurred several breaches of contract, for example neither presenting a compliance nor a legal liability policy.

During that same year, the concessionaire was also fined by commerce and industry regulator SIC for excessive access fees to its main runway.

Since then, both airports have been operated by Colombia’s aviation regulator Aerocivil.

The new, 20-year concession entails expansion works for both terminals. In the case of San Andrés, the passenger terminal would have to be rebuilt and new boarding bridges installed, bringing the airport’s capacity to 3.5mn passengers per year.

As for Providencia, ANI hasn’t given details about possible works, but last year Aerocivil was forced to modify a contract to widen the airport’s runway after the San Andrés and Providencia departmental tribunal ruled against the project following a legal action presented by locals, RCN Radio reported.

Southwest airports (782bn pesos)

This concession would entail the airports of the cities of Cali (Valle del Cauca department), Neiva (Hulia), Ibagué (Tolima), Buenaventura (Valle del Cauca) and Armenia (Quindío).

Currently, only the Cali airport is operated by a concessionaire (Aerocali), while the others are administrated by Aerocivil.

ANI has already socialized the project to tender all five airports under one concession, according to its website.

Works in this concession include one new terminal for domestic flights, another one for low-cost airlines, a new control tower, an expansion of the current platforms and runways and buying land plots for a second runway.

Armenia’s airport would have to get a new cargo terminal with its respective platform. Buenaventura’s airport, meanwhile, would get a new terminal building, a new control tower, firefighter building, and will get an expansion of its parking lot, runway and passenger platform.

Expected works at Ibagué’s airport include demolishing its old terminal and rehabilitate its main runway, among others, while at Neiva only a new perimeter area and a fueling station are planned.

In March ANI reported that prefeasibility documents have already been delivered by Spanish airport operator AENA and Colombian financing firm Corficolombiana, which proposed the concession as a private initiative.

Cartagena airport expansion (331bn pesos)

Expanding Cartagena’s Rafael Núñez airport was presented as a private initiative by the airport’s concessionaire Sacsa, and is separate from the airport’s current expansion.

As of April, according to ANI, this second expansion entered its feasibility stage and is expected to be finished by late 2021.

Works entail building an international terminal, a loading bay next to the existing building, expansion of the domestic terminal, expansion of the plane parking lot to receive up to 15 Type A 320 planes, a new taxiway and an elevated car parking lot.

These improvements would increase the airport’s capacity to 7.5mn passengers per year, up from 4.6mn.

New Cartagena airport (2tn pesos)

This venture is another private initiative, presented by a consortium headed by the current operator of Bogotá’s El Dorado airport, Odinsa.

Developed under the PPP model, this project entails building of what ANI called an «airport citadel.»

The complex would be 24km from Cartagena’s historic center and accessed via Vía al Mar and La Cordialidad roads. Its first phase includes building a 3,100m runway, a passenger terminal, a parallel taxiway and a platform with boarding bridges and remote positions.

Once the first phase is complete, the new airport will have capacity for 9mn passengers per year, but it could reach up to 30mn in its last phase, according to Odinsa.

The project is still in its feasibility stage and according to ANI the first stage would conclude by 2025.

El Dorado II (3.5tn pesos)

This project has been in its structuring phase since last year, and transport minister Germán Cardona stated in May that structuring and financing will be ready before Duque takes office. A tender would be launched around that time, according to the transport ministry and RCN Radio.

The airport would be located alongside the highway connecting the municipalities of Madrid and Facatativá to the west of Bogotá. It will cover an area of around 1,350ha.

Last month ANI reportedly received two private initiatives regarding Bogotá’s existing and future airports.

One of them involves a concession for the runway network of the existing El Dorado airport. The second one, dubbed Sistema Aeroportuario de Bogotá 2025, involves an expansion for the facility, a new passenger terminal, a third runway and the first stage of El Dorado II. The feasibility of both proposals and eventual tenders will fall to Duque’s administration.

Source: BNAmericas

ANI (Agencia Nacional de Infraestructura de Colombia) is currently structuring five investment projects that entail new concessions for seven airports, the expansion of nine existing terminals and building nine new ones, for a total investment of 6.8tn pesos (US$2.4bn).

ANI (Agencia Nacional de Infraestructura de Colombia) is currently structuring five investment projects that entail new concessions for seven airports, the expansion of nine existing terminals and building nine new ones, for a total investment of 6.8tn pesos (US$2.4bn). The Gautam Buddha International Airport is likely to come into operation within 10 months if things go as planned.

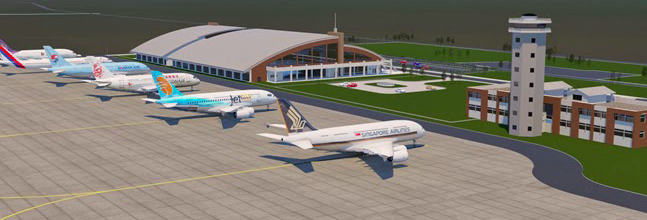

The Gautam Buddha International Airport is likely to come into operation within 10 months if things go as planned.