There are no fewer than 150 investment opportunities in 19 of the Nigeria’s airports, a document obtained by our newspaper.

There are no fewer than 150 investment opportunities in 19 of the Nigeria’s airports, a document obtained by our newspaper.

This is as the Federal Airports Authority of Nigeria (FAAN) has categorised 20 of the nation’s airports into four with the Murtala Muhammed Airport (MMA), Lagos, Nnamdi Azikiwe Inetrnational Airport (NAIA), Abuja and Port Harcourt International Airport (PHIA), Omegwa, rated among the premium international airports in the country by the agency.

A document obtained by INDEPENDENT revealed that Lagos, Abuja, Kano, Port Harcourt, Calabar, Enugu, Jos, Kaduna, Maiduguri, Sokoto and Yola Airports are among the 19 airports with different investment opportunities the airport manager required investors to invest in.

Others are Katsina, Ilorin, Akure, Ibadan, Benin, Makurdi, Minna and Owerri Airports.

For the projects to be executed, the report revealed that FAAN sought the partnership of potential investors in different operating models like Build Operate and Transfer (BOT), Build-Own-Operate-Transfer (BOOT), Design Build Finance and Operate (DBFO) and Management Concession.

The document indicated that Lagos, Kano and Port Harcourt Airports led the other airports with 12, 15 and 13, investment opportunities, respectively.

On investment opportunities at Lagos Airport for instance, FAAN sought the collaboration of investors in the area of mono-rail transport system, public gallery, airport hotel facility, surface ground transportation, car park development, mixed use shopping malls, cargo complex/ware house and automated trolley management system.

Others are banking pavilion, aircraft maintenance facility, petrol stations and training centres for aviation related programmes.

At Kano Airport, FAAN said there were investment opportunities in airport hotel facility, multi-storey car park development, mixed use mall, shuttle bus services, housing estate, surface ground transport, aircraft maintenance facility, in-flight catering complexes, office complex, cargo complex, automated trolley management system, petrol stations, cell site installation and independent power project.

For Port Harcourt International Airport where FAAN planned 13 investment opportunities, it encouraged investors to partner with it on airport hotel facility, resort centres, horticulture/flower gardens, conference centre, amusement park, rail transportation system, airline office complex, missed use mall and in-flight catering complexes.

Others are office complex, cargo and warehousing complex, automated trolley management system, banking pavilion, petrol stations, cell site installation and independent power project.

Some of the investment opportunities identified at Calabar Airport included aviation fuel farm, airport hotel facility, housing estate, surfacing ground transportation, aircraft maintenance facility and independent power project among others.

Other airports in which FAAN is seeking collaboration with private investors included Enugu, Maiduguri and Jos airports with six projects each lined up; Kaduna; 10, Sokoto; seven, Yola; five, Katsina; five, Ilorin; four and Akure with 12.

Ibadan, Benin, Makurdi, Minna and Owerri Airports had 11, five, three, six and 11 investment opportunities, respectively in which the agency was seeking investors for.

On the categorisation of the airports, FAAN had placed Lagos, Abuja and Port Harcourt as its premium international airports while in its category two were Kano and Enugu airports.

For category three, which it placed as premium secondary (domestic), FAAN categorised four airports; Imo, Kaduna, Calabar and Benin Airports.

The fourth category comprised Ilorin, Jos, Maiduguri, Ibadan, Sokoto, Ondo, Katsina, Minna, Markurdi, Yola and Zaria airports.

The report added: “Our airports are prime areas for high yield investment and income stream, FAAN generates revenue from a variety of sources, which consist of income generated from land lease concessions, retail concessions, advertising and branding, commercial and cargo services.”

It would be recalled that FAAN had last week in Lagos met with its contractors and commercial banks in the country to device how they could work together to execute some of its projects in the industry.

Speaking at the occasion, Mrs. Adenike Aboderin, Director of Finance and Accounts, FAAN noted that there were great opportunities for risk asset creation for banks and job creation for Small and Medium Enterprises (SMEs) with the agency’s continued investment towards the upgrade of infrastructure, especially its old terminal buildings.

Aboderin said FAAN was growing and that the collaborative effort between contractors, insurance companies and commercial banks would be of tremendous benefits to all parties involved, especially with all the advancements and improvement the agency still had at hand.

She said: “We would like to thank you once again for meeting with us, as we look forward to a mutually beneficial relationship and more opportunities for collaboration. Let me quickly reiterate that this collaborative effort between contractors, insurance companies and commercial banks will be of tremendous benefits to all parties involved.

“For us as an institution, we would continue to invest towards the upgrade of our infrastructure, most importantly our old terminal buildings. This presents a great opportunity for risk asset creation for the Banks and job creation for our SMEs. To our contractors, we thank you for your partnership as we look forward to working with you all to upgrade our facilities in the coming years.”

Source: The Independent

Workers at the Grantley Adams International Airport Inc. (GAIA) are to be offered shares in that corporatized state enterprise in an arrangement which will also see the nation’s lone airport being run by a concessionaire, Prime Minister Mottley has revealed

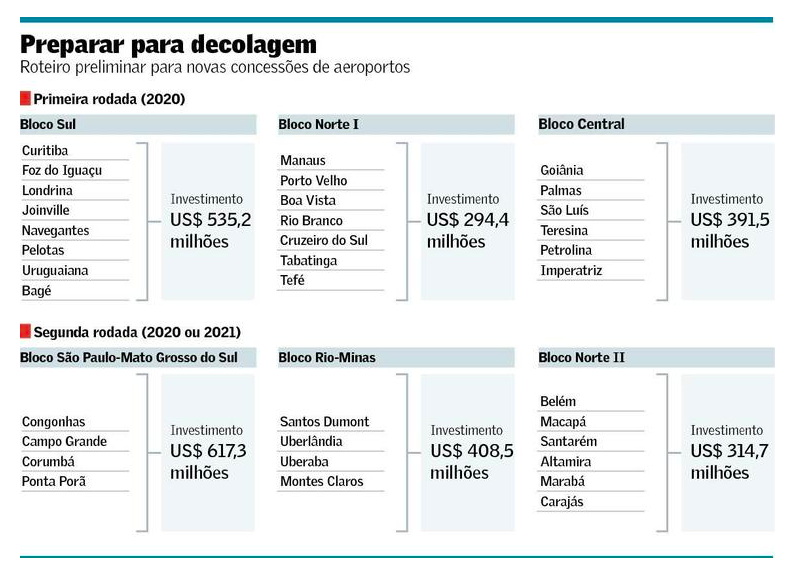

Workers at the Grantley Adams International Airport Inc. (GAIA) are to be offered shares in that corporatized state enterprise in an arrangement which will also see the nation’s lone airport being run by a concessionaire, Prime Minister Mottley has revealed El equipo del presidente electo, Jair Bolsonaro, ya cuenta con una hoja de ruta para llevar a cabo las concesiones aeroportuarias. El plan prevé dos nuevas rondas para transferir 44 terminales a la iniciativa privada. Este es el tamaño de la red que seguirá bajo el control de la estatal Infraero tras la próxima subasta del sector, preparada por el actual gobierno.

El equipo del presidente electo, Jair Bolsonaro, ya cuenta con una hoja de ruta para llevar a cabo las concesiones aeroportuarias. El plan prevé dos nuevas rondas para transferir 44 terminales a la iniciativa privada. Este es el tamaño de la red que seguirá bajo el control de la estatal Infraero tras la próxima subasta del sector, preparada por el actual gobierno. Over a dozen global airport operators are interested in the thirty-year concession of Podgorica and Tivat airports, Montenegro’s Minister for Transport and Maritime Affairs, Osman Nurković, has said. The future concessionaire will be obligated to make a minimum one-off payment of 100 million euros to the Montenegrin government and will be required to invest at least 85 million euros into the two airports, which are being offered to investors as part of a single package. The yearly concession fee will total 10% of gross annual income. «We have drafted the concession agreement, which is to be adopted by the cabinet shortly, after which we will commence tender procedures. We anticipate strong interest from investors».

Over a dozen global airport operators are interested in the thirty-year concession of Podgorica and Tivat airports, Montenegro’s Minister for Transport and Maritime Affairs, Osman Nurković, has said. The future concessionaire will be obligated to make a minimum one-off payment of 100 million euros to the Montenegrin government and will be required to invest at least 85 million euros into the two airports, which are being offered to investors as part of a single package. The yearly concession fee will total 10% of gross annual income. «We have drafted the concession agreement, which is to be adopted by the cabinet shortly, after which we will commence tender procedures. We anticipate strong interest from investors».